Small Buyout Market Commentary January 2024

Here’s to 2023! It may seem odd to toast a year that we have grown accustomed to worrying about for each of the past twelve months. In fairness, there was plenty to worry about:

- The world needed to recalibrate after the disruption caused by the pandemic; basic supply and demand imbalances in goods, services, and labor; putting these pieces back together was untested and fraught with risk.

- Rapid inflation set in, with all of its actual and psychological destructiveness.

- Interest rates were raised at their fastest pace in memory to combat inflation, but this brought about another set of fears and risks: will the cure be worse than the disease?

Of all these 2023 concerns, we have repeatedly cited interest rates as our primary focus. Why? Aside from the general economic concerns, rapidly rising rates can strike at the heart of the inner workings of the buyout business. Most directly, high rates on any leveraged company increase costs and shift value away from equity holders. When these costs become excessive, default and investment destruction can follow. Also, since interest rates are a major variable in asset pricing models, rising rates (at least, in theory) can have a dampening effect on investment values, including the values of unrealized holdings and the price that buyers may offer for portfolio companies. Finally, a period of rising rates can lead to economic recession. The specter of this vicious cycle was a real concern when we started the year.

So, we ended 2023 with a sense of relief and celebration, because many of these ill effects were avoided both in the overall economy and even more so in the small buyout market.

In the broader economy, 2023 was a mixed bag, but it is ending on a hopeful note. There are signs that credit tightening has worked as hoped for: inflation is coming down and a recession has been avoided. High rates have been damaging, but the Fed’s recent signaling on possible future reductions was welcome news. Policy makers seem to have threaded the needle well.

The smaller cap private equity market certainly benefited from the bad news that didn’t happen. However, small buyouts inherently benefited even more from certain protective features. Higher interest expenses certainly hurt the bottom line. However, financial strain or distress was not a major factor in our segment of the market, even though we lived through a full year of higher rates. This is primarily due to the lower leverage inherent in small buyouts. This was a lifesaver in 2008/2009, and it worked again in 2023. Unlike 2008, however, we avoided a recession this year, so we marveled at the maintenance of strong operating performance in most industry segments throughout the small buyout market.

Without high debt or widespread operational difficulties, small buyout companies enjoyed the flexibility to continue (and, in many cases, accelerate) their value creation plans (both organic and through smaller add-on acquisitions). Small buyout valuations also proved to be quite stable and resilient during the year, certainly more so than seen in the larger buyout or growth strategies. This happened – even during an otherwise challenging year – because small company values were more moderate to begin with, and we were not significantly exposed to industries or strategies that became overpriced during the pandemic.

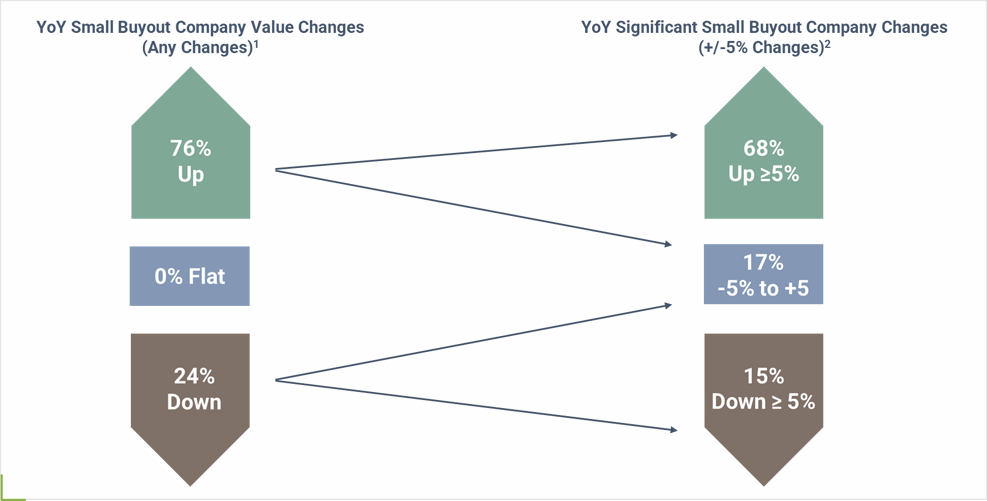

As we go through our end-of-year portfolio review, we see this manifested in strong value measurements. At the beginning of the year, it was widely accepted that 2023 would be a tough year for private equity values. We have now received September 30 valuations from most GPs across our portfolio, and the results are encouraging. A quick metric to show this is the year-over-year percent change in ROIC/TVPI for the underlying investments in a sample set of small buyout companies (140 fund investments in total for the last 12 months ending 9/30/23). There were many more winners than losers. When we dig a bit deeper into this metric – to focus on areas of significant gain or loss (which we defined as value changes during the same 12-month period of +/- 5%) – the results are even more encouraging:

Not only are “the ups more than the downs,” but, when value changed, there was more significant movement on the upside. Overall, the median change of value over the past year was +13%, and there is still a final quarter to report in calendar year 2023. The state of small buyouts is strong.

We won’t miss 2023 completely. High rates, tighter credit, and the general unsettled nature of the market suppressed deal flow, including exits. M&A conditions always ebb and flow; good private equity sponsors know this and have the flexibility to adjust exit timing to maximize return. While cash returned to investors in 2023 was lower, we take great solace in owning portfolios with significant embedded and growing value. “Exit ready” is a term we hear increasingly from our GPs as they talk about their portfolio companies. As we bid a mostly fond farewell to 2023, this is a good term to keep in mind as we toast the beginning of 2024.