Lower Middle Market Buyout Deal Returns—Sector & Macroeconomic Cycle Overview

Lower Middle Market Deals Generate Attractive Risk/Return Across Different Macroeconomic Environments, But Industry and Vintage Years Matter for Relative Assessment

RCP Advisors (“RCP”) is proud to share its latest research presentation: Lower Middle Market Buyout Deal Returns – Sector & Macroeconomic Cycle Overview. Leveraging more than two decades of proprietary data and research focused on lower middle market transactions, RCP is uniquely positioned to assess performance distribution across different industry groups and vintage year periods. This report focuses on deals by high-level industry groups (Industrials, Healthcare, Technology, Consumer, and Financials) as well as across macroeconomic environments (Pre-Recession, During Recession, Post-Recession, and Economic Expansion).

Highlights Include:

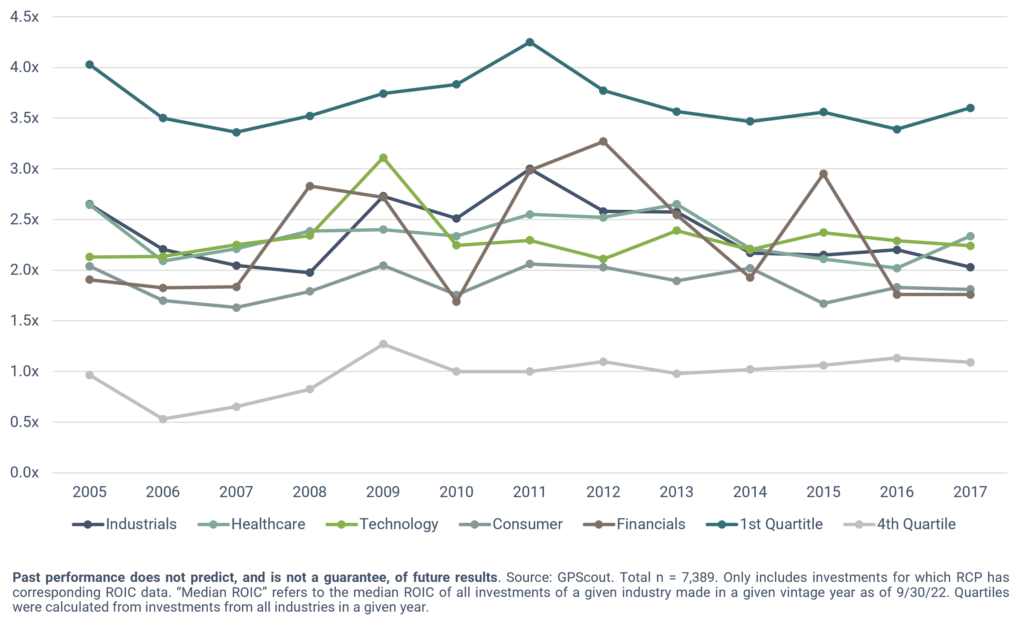

Top quartile deals in the Lower Middle Market typically return more than 3.5x ROIC on a gross basis, while bottom quartile deals have returned 1x ROIC or better for the past decade.

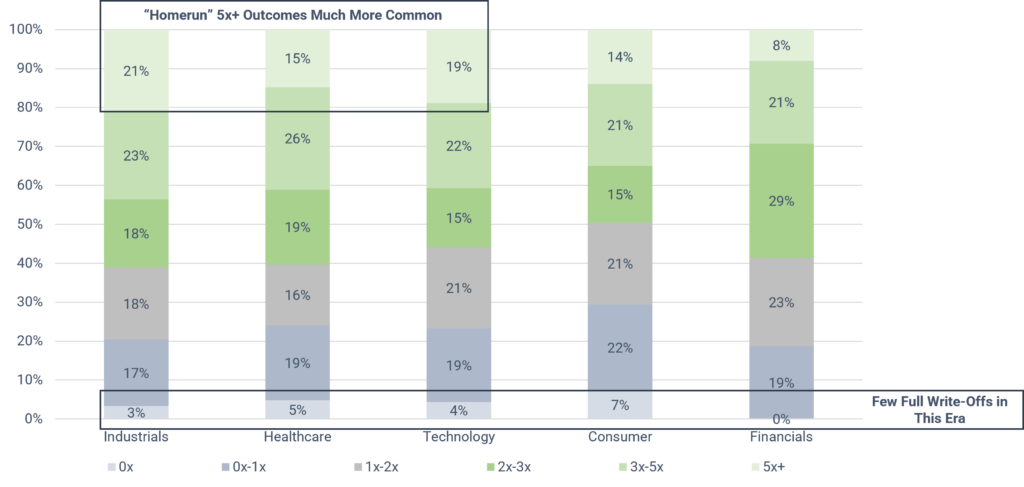

Even in years preceding a financial crisis, Lower Middle Market Buyouts generated strong returns, with most sectors having 50%+ of deals return 2x+ ROIC, and less than 10% of deals being written off.

While difficult to predict when the macroeconomic environment turns, consistent investors in the space benefit from great risk/return coming out of recession, with Industrial, Healthcare, and Technology deals having a 15% to 21% chance to return 5x+ ROIC.

For additional details on 2012 to 2014 and 2015 to 2017 vintage years, as well as conclusions and key takeaways from our research, please download the report below.